Subscribe

Fed Delivers Second Straight Rate Cut

Week of October 27, 2025 in Review

With the Fed implementing its second rate cut of the year, the big question is whether more easing could follow in December. Also, what’s the latest on home prices and contracts? Here’s what you need to know.

- Fed Cuts Rates for Second Time This Year

- Annual Home Price Appreciation Moderates

- Pending Home Sales Flat in September

- What to Look for This Week

- Technical Picture

Fed Cuts Rates for Second Time This Year

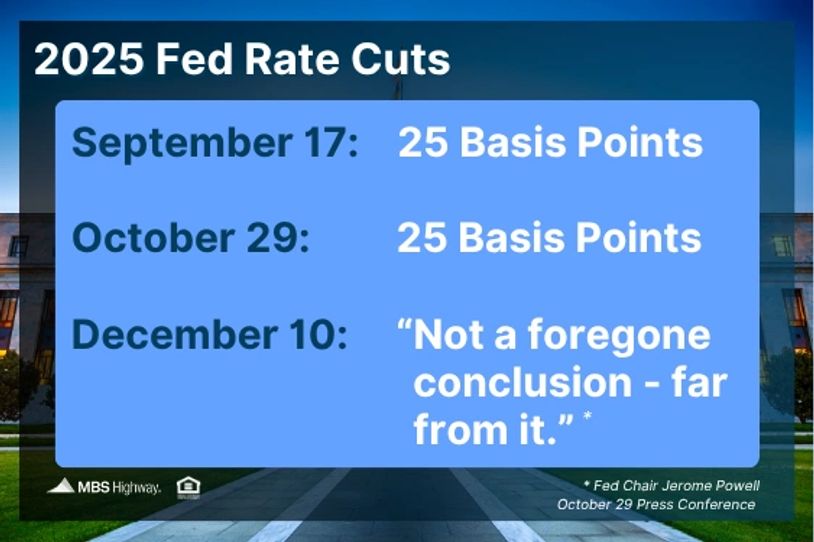

The Federal Reserve lowered the benchmark Fed Funds Rate by 25 basis points to a target range of 3.75% to 4%. The move, widely expected, follows a similar cut in September as the Fed balances concerns over persistent inflation and a weakening job market.

Despite some data delays from the government shutdown, the Fed noted that available numbers suggest little change in the overall outlook since September. With inflation still above target but labor market risks rising, committee members judged that easing policy again was warranted.

Two officials dissented: new Governor Stephen Miran, who favored a larger 50-point cut, and Kansas City Fed President Jeffrey Schmid, who preferred no change.

Keep in mind: The Fed Funds Rate is what banks charge each other for overnight loans. It doesn’t directly set mortgage rates, but it influences borrowing costs across the economy.

What’s the bottom line? The Fed is walking a fine line – trying to curb inflation while supporting the labor market. Chair Jerome Powell warned there’s “no risk-free path” forward, noting that committee members remain divided. He emphasized that another rate cut at the December 10 meeting “is not a foregone conclusion – far from it.”

Annual Home Price Appreciation Moderates

The Case-Shiller Home Price Index – a key measure of U.S. home values – showed a 0.3% decline in prices from July to August before seasonal adjustments, but a 0.2% gain after adjusting for seasonality. Nationally, prices remain 1.5% higher than a year ago, down slightly from July’s 1.6% annual increase.

Meanwhile, the FHFA Index reported a stronger 0.4% monthly rise after seasonal adjustment and a 2.3% annual gain. Unlike Case-Shiller, FHFA data only reflects homes financed with conventional mortgages, excluding cash and jumbo loan transactions.

What’s the bottom line? Home prices are still higher than last year, but growth has cooled. If mortgage rates continue to decline, renewed buyer demand could once again push prices upward.

Pending Home Sales Flat in September

Pending Home Sales were unchanged from August to September, coming in slightly below expectations for a modest gain. Still, activity matched the second-strongest pace of the year, according to the National Association of REALTORS® (NAR). Compared to a year ago, contract signings were down just 0.9%.

What’s the bottom line? Pending Home Sales track signed contracts on existing homes and often signal closings one to two months ahead. While higher rates later in September likely kept some buyers on the sidelines, NAR Chief Economist Lawrence Yun noted that “looking ahead, mortgage rates are trending toward three-year lows, which should further improve affordability.”

What to Look for This Week

While government labor data (job openings, jobs report, jobless claims) remains delayed due to the shutdown, ADP’s October employment report that releases Wednesday will offer key insights into private-sector job growth.

Technical Picture

Mortgage Bonds ended last week sitting right at their 25-day Moving Average. If they can break above this level, there’s almost 50 basis points of upside before hitting resistance at 101.42. The 10-year Treasury continues to trade within a range, capped by resistance at the 50-day Moving Average and support at the 25-day.

Sunset Of The Week: Bequia

SECURITYNATIONAL MORTGAGE COMPANY © 2024 ALL RIGHTS RESERVED. | CO. NMLS #3116 | JUAN PATINO NMLS #2155091 EQUAL HOUSING LENDER

Powered by IMPACT

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.